Maximizing Your Tax Refund and Minimizing Your Tax Burden To Help You and Your Business.

My goal is to serve as your Competent Professional Adviser, my idea of a CPA, rather than just a number crunching Certified Public Accountant.

Extensive experience in accounting, financial planning, management consulting, and tax planning and tax preparation for businesses, individuals and not-for-profit organizations.

Business tax experience includes corporations, S-corporations, partnerships and limited liability companies ranging from startups to small businesses (I am a small business owner) to companies with up to $1 billion in revenue.

Industry experience in real estate, technology (software and internet), financial services, and professional services (in the fields of law, medicine, architecture, and consulting).

Individual tax experience includes stock option planning (NQ, ISO, ESPP, RSU) and equity compensation planning. Experience with high net worth individuals (including Fortune 500 executives), expatriates living outside the U.S., and nonresidents (non-U.S citizens and non-green card holders).

Personal financial planning experience includes budgeting, college savings, retirement planning, explaining investments (without sales pressure) and estate planning.

Not-for-profit experience includes experience with public charities, private foundations, schools, social clubs and trade associations.

Richard has been quoted on a variety of tax and financial topics in publications such as the Wall Street Journal, San Francisco Chronicle, Investment News, USA Today, New York Times and even the Wrestling Observer Newsletter (on tax treatment of WWE pro wrestlers as independent contractors).

Richard was voted the winner of 2025 and 2024 SFgate.com’s Best Tax Services Award.

Contact

➤ LOCATION

Serving clients in San Francisco, Northern California and throughout the world. Located in the heart of San Francisco’s start-up community in the Yerba Buena and SoMa (South of Market) neighborhood.

☎ CONTACT

Contact me to maximize your refund, minimize your taxes and manage your complex financial affairs.

Areas of Practice

TaX PLANNING

Taxes are complicated. Some states follow federal rules and other states like California have unique set of rules. Businesses face a myriad of taxes including income tax, payroll tax, sales tax, use tax and local taxes. Whether your issue is stock options, choice of business entity or M&A due diligence, Richard Pon, CPA is here to help with your tax planning needs.

As a father, I pay close attention to tax law changes that impact families. I advise on issues such as education funding (such as 529 plans) or the”kiddie tax.” In fact, I was quoted in the Wall Street Journal on changes to the “kiddie tax” rules.

As a small business owner, I pay close attention to tax law changes that impact small and family businesses that are the backbone of America’s economy.

FINANCIAL PLANNING

Richard is a Certified Financial Planner (CFP®) practitioner. CFP® certification is generally recognized as the highest standard in personal financial planning, qualifying financial planning professionals to provide their clients with comprehensive financial advice. Whether it’s budgeting, education savings, retirement planning, insurance, investment explanations or estate planning, Richard Pon, CPA, CFP® is here to help.

Richard is a fee-only financial planning practitioner which means he will not sell you insurance or investments.

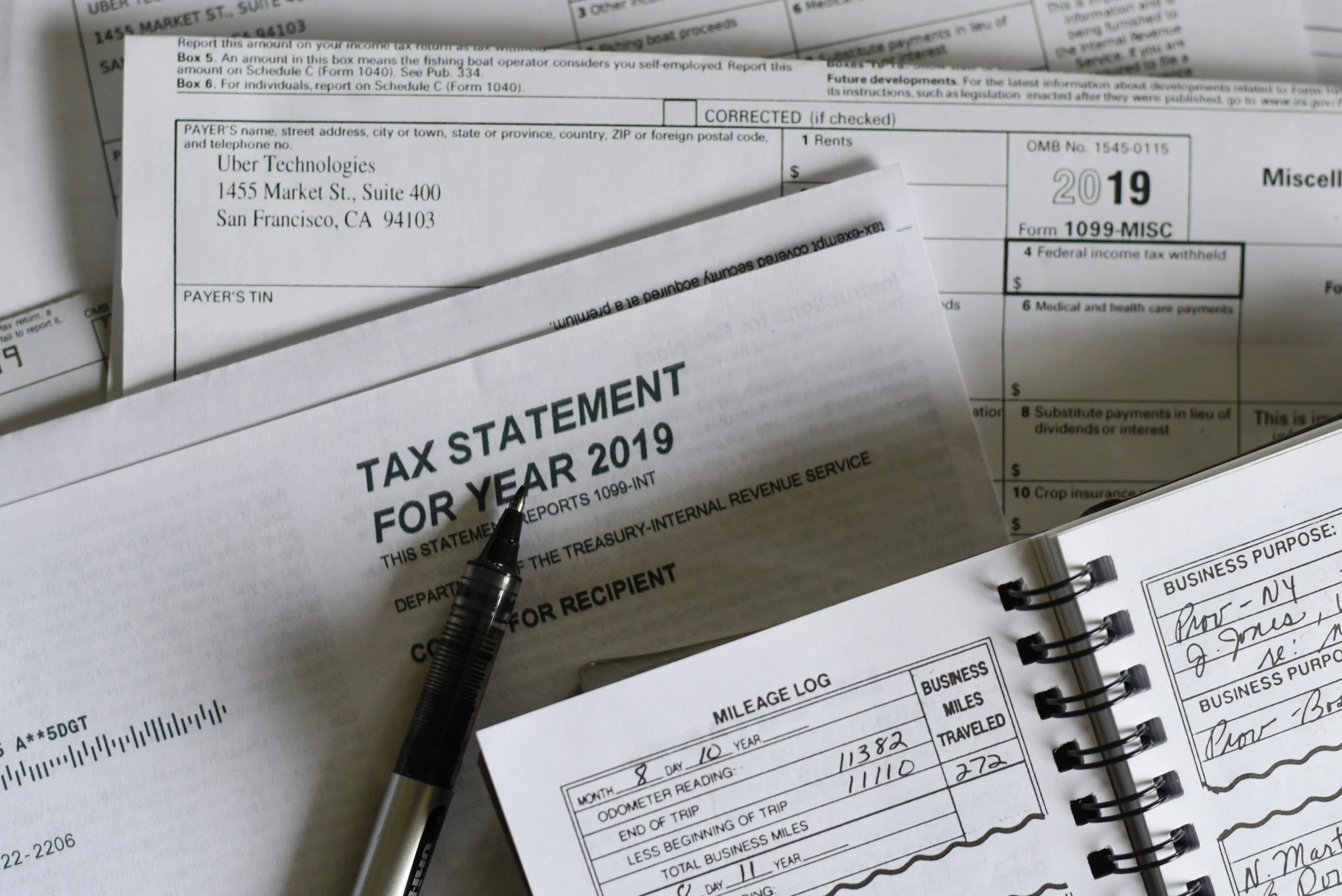

TAX RETURN PREPARATION

Richard Pon, CPA is here to help with your tax return preparation. Tax return preparation is provided for individuals, corporations, partnerships, limited liability companies (LLC), trusts, nonprofit organizations (including charities, private foundations, and business leagues.) Nonprofit tax services include public support status, statement of functional expense and unrelated business tax reporting.

Most taxpayers treat their tax filing as an annual chore. I see it as an opportunity to understand your situation and to plan to minimize future taxes.

For employer securities I work with RSUs, ISOs, NQ options and ESPP. I have seen option exercises over $100 million.

BUSINESS SUPPORT SERVICES

The startup and small business marketplace has a lot to deal with. Whether it's budgeting, accounting, risk management, human resources or financial planning, Richard Pon, CPA is here to help as your trusted CPA (Competent Professional Adviser - my idea of a CPA is more than just serving as an accountant) and tax consultant.

Nonprofit accounting services include statement of functional expense reporting which is required for all nonprofits with audited financial statements since 2018.

TAX AUDIT REPRESENTATION

Fighting the government is a draining battle. Richard Pon, CPA may represent you or your company in income tax, payroll tax, sales tax, use tax or property tax audits.

Richard convinced a New York use tax auditor that their sampling methodology was biased and an assessment was reduced from $265,000 to $24,000.

Richard helped a new client amend their corporate return and defended the amended return in a successful audit that resulted in a $300,000 California refund.

Richard helped a new client who had bad accounting records, reduce their corporate income tax from $100,000 to $71.

Richard helped a new executor abate $50,837 late filing and late payment penalty assessed against an estate. Richard appealed the case to Taxpayer Advocate.

PART-TIME & INTERIM CFO

Hiring a part-time CFO on an as-needed basis can help you learn many important things about your business’ finances as well as reduce costs. Small changes to a current business operations can have a dramatic increase in your company’s bottom line.

Richard Pon, CPA is here to serve as your part-time CFO. I help make sense of your numbers.

Let's Chat.

Use the form below to contact us regarding your inquiry. Please be as detailed as possible. To help us best service your inquiry, we recommend that you first describe the issue you’re having before telling us what you want to achieve. You may also email us to make an appointment.

PLEASE NOTE, MINIMUM TAX RETURN PREPARATION FEE IS $1,000.

You can also request our FREE planning letters:

(1 ) 2025 NEW YEAR. NEW TAX & EMPLOYMENT LAWS.

(2) NONPROFITS - WHAT TAX RETURNS DO YOU NEED TO FILE?

(3) SECURE ACT 2.0 RETIREMENT PLAN CHANGES